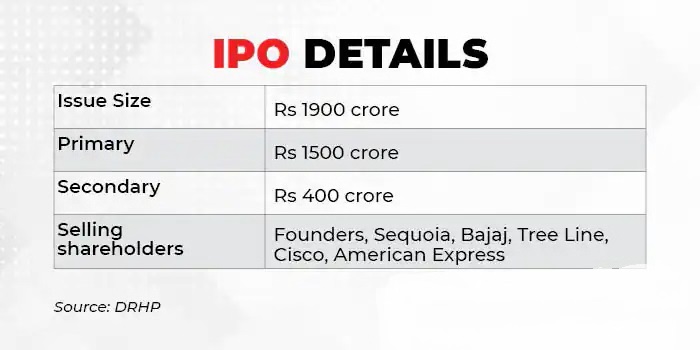

Today we are going to give you an update about MobiKwik company IPOs details. All the necessary details you need to know while dealing with its shares in the market. A private fintech corporation MobiKwik IPO get SEBI’s leads on October 11, 2021. The tech company is about to elevate ₹1900 crores i.e Initial Public Offer that includes a fresh issue of 1500 crores and an offer for sale up to 400 crores at a face value of ₹2 per equity share. That offer would absolutely go to hit the share market soon.

What Is MobiKwik IPO? When IPO Will Launch?

The MobiKwik IPO registered DRHP (Draft Red Herring Prospectus) with SEBI (Security Exchange Board of India) on 12 July 2021 and cleared by SEBI. The company have plans to put up ₹1900 crore share through Initial Public offerings. The MobiKwik company is one of the leading mobile wallets and prime in the BNPL (Buy Now Pay Later) player in India.

The company’s co-founder is Bipin Preet Singh and Upasana Taku. They had initiated the company in 2009. These are the investing partner of the company are Sequoia Capital India, Bajaj Finance NSE 0.08%, American Express, Cisco and Abu Dhabi Investment Authority.

The company’s founder owns at 34.8%, while Sequoia Capital India and Bajaj Finance are expecting to sell shares around ₹ 95 crores and 69 crores.

Also Read: Go Fashion IPO (Go Colors) IPO Date, Review, Price, Form, GMP, Market Lot, & Details

MobiKwik IPO Important Details

These are the important details that you should know: –

- At present it is popular and one of the leading mobile wallets, a mobile payment app in India.

- The company got payment access of Zaakpay that offer end to end payment solution merchants using many payment options.

- MobiKwik Zip and Zip EMI facilitate the buy now pay later option for their users.

- They have registered more than 10 crore users and over 34 lakh E-Commerce retails and Biller partner

- The company had beard a loss of ₹111 crores in 2021 over 99 crores in the year 2020

MobiKwik IPO Date & Price Band

| IPO Open: | October 2021 |

| IPO Close: | October 2021 |

| IPO Size: | Approx ₹1900 Crores |

| Fresh Issue: | Approx ₹1500 Crores |

| Offer for Sale: | Approx ₹400 Crores |

| Face Value: | ₹2 Per Equity Share |

| Price Band: | ₹ to ₹ Per Share |

| Listing on: | BSE & NSE |

| Retail Quota: | 35% |

| QIB Quota: | 50% |

| HNI Quota: | 15% |

MobiKwik IPO Market Lot

The MobiKwik IPO minimum market lot is – shares with ₹- application amount. The retail investors can apply up-to – lots, – shares with ₹- application amount.

| Minimum Lot Size: | Shares for 1 lot |

| Minimum Amount: | ₹- for 1 lot |

| Maximum Lot Size: | Shares for – lot |

| Maximum Amount: | ₹- for – lot |

MobiKwik IPO

Date, Time Table, Allotment & Listing

The opening date of releasing IPOs on October 2021 and the closing date is October 2021. The allotment date is October 2021 and the IPO may list in November 2021

| Price Band Announcement: | October 2021 |

| Anchor Investors Allotment: | October 2021 |

| IPO Open Date: | October 2021 |

| IPO Close Date: | October 2021 |

| Basis of Allotment: | October 2021 |

| Refunds: | October 2021 |

| Credit to Demat Account: | October 2021 |

| IPO Listing Date: | November 2021 |

MobiKwik Company Financial Report

| ₹ in Crores | |||||

| Revenue | Expenses | PAT | |||

| 2019 | ₹160 | ₹302 | -₹147.97 | ||

| 2020 | ₹370 | ₹454 | -₹99.92 | ||

| 2021 | ₹302 | ₹404 | -₹111.30 | ||

If you would like to know the review of the other company’s IPO detail and performances keep joining us on All Social Updates.